Pitfalls of Joint Ownership

Joint ownership may seem like an easy way to share asset., However, it can create legal, financial and tax complications that could harm you and your heirs.

Our Estate Planning Blog

Joint ownership may seem like an easy way to share asset., However, it can create legal, financial and tax complications that could harm you and your heirs.

Choosing the right storage location for your will ensures that it remains secure, accessible, and legally valid when needed.

Inheriting a timeshare often comes with financial burdens, ongoing fees and legal complications that heirs may not anticipate.

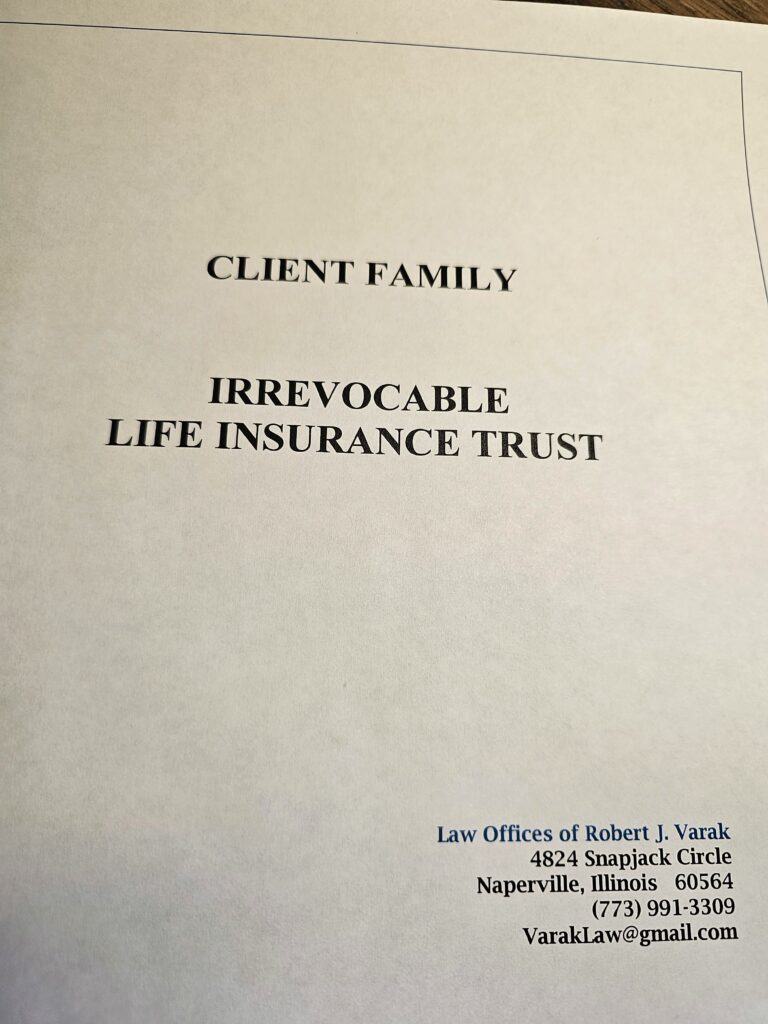

An irrevocable life insurance trust (ILIT) protects high-net-worth estates by reducing tax liability and ensuring a structured transfer of wealth.

Legal tools like power of attorney and healthcare directives are essential in forming a proactive legal strategy for cognitive decline.

Carefully structuring an inheritance can safeguard a child with addiction from financial harm, while providing the support they need to recover.

While the focus tends to be on the growth of the asset class and opportunities to prosper, for many cryptocurrency investors, more attention must be paid to transferring assets to loved ones and protecting the store of wealth from unfounded and frivolous lawsuits.

Trust disputes among beneficiaries can strain family relationships and jeopardize the integrity of an estate plan. Strategic conflict resolution can protect both the trust’s assets and familial bonds.

If these things get overlooked, you risk leaving your loved ones with extra challenges during what’s already a tough time.

Good communication together with strategies like no-contest clauses and competency verification can help you avoid a will contest.