How to Avoid Estate Planning Mistakes in 2025

If these things get overlooked, you risk leaving your loved ones with extra challenges during what’s already a tough time.

Our Estate Planning Blog

If these things get overlooked, you risk leaving your loved ones with extra challenges during what’s already a tough time.

Digital assets are now a major cause of problems in settling and distributing estates. You must carefully consider and incorporate your digital life into the estate plan.

You may love your son-in-law or daughter-in-law now, but that could change down the road. So, if you don’t want your money going to your child’s future ex, here’s what you should do.

What happens if you inherit your loved one’s home? What if they still have payments to make on their mortgage?

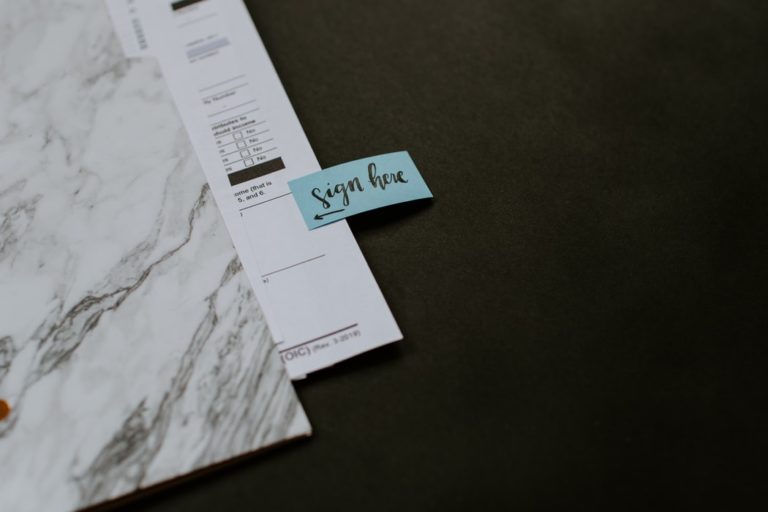

Trusts are legal entities that own assets, and all trusts are not alike. They are created by a written trust document with certain provisions that can vary from trust to trust.

With COVID-19 impacting more and more Americans, individuals across the country are scrambling to set up wills and end-of-life directives.

Running and owning a business is just like raising a child: Both are investments in the future, and both require a lot of time, resources and effort to raise successfully. One can argue that you would treat your business like you’d treat a child; you’d want it to succeed even after you’ve passed on or retired.

These changes are so significant that every such plan holders should review their wishes and how their estate plans may be affected.

If you think Estate Planning is simply the creation of a will or trust, you are missing a large portion of information, and could potentially have assets that do not flow according to the plan you have set up in your will or trust.

You should go to an estate planning attorney to sort things out and make sure both of you are on the same page about who owns what, who gets to stay where and for how long into the future.