The COVID-19/ Coronavirus is the largest global health challenge in many years. The disease, and the policies enacted by governments in an effort to contain it, are causing nearly unprecedented disruption of financial markets and commerce. This has created a full-on financial panic, with stock indices across the globe plunging. We should all be primarily concerned with doing what we can to minimize the risk to ourselves, our families, and our communities. Beyond that though, it is a good time to assess the risks to your financial well-being as well. So what is the impact of Coronavirus on your financial and estate planning?

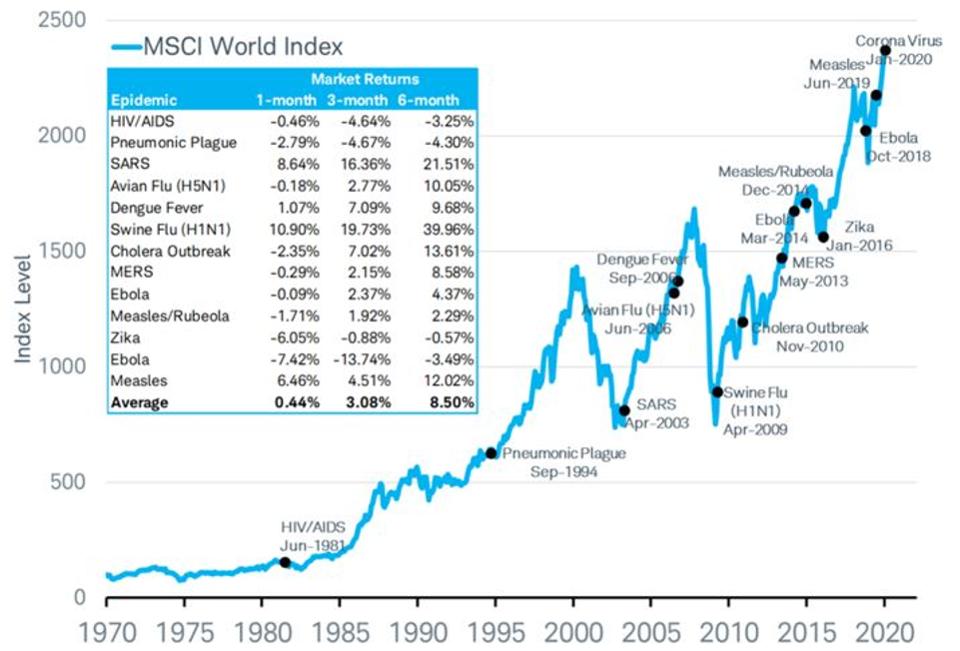

According to Jeff Camarda in Forbes, the most important thing is to maintain a sense of perspective and balance. In his column, Coronavirus Stock Crash Impact on Your Retirement and Financial Planning, he makes it clear that even events this momentous are not without historical precedent. He emphasizes that over the long term, events like this have never before stopped the creation of wealth and increasing prosperity. Camarda, like many financial experts, reminds us that it was the consensus on Wall Street for some time that a correction was necessary in the securities markets. It may be that the Coronavirus crisis just provided the immediate impetus for something that was inevitable in any case. Even if we are entering an extended down market, he suggests this is no reason to withdraw your money. Nor is it time to stop adding funds to 401k plans or other investments on a regular basis. Over time, the market will continue to add value.

That said, the public health impact should not be ignored. The impact of Coronavirus on your financial and estate planning does not stop at the stock market. There is no reason to panic or overreact, but this is an opportune time to make sure, as you should even in the absence of a crisis, that all of your healthcare directives and estate planning documents are up to date and reflect your current wishes.

Every adult, including young adults, should have a medical power of attorney for the state in which he or she resides. Living trusts, facilitating as they do the avoidance of probate, should be in place and assets properly titled to work with those trusts. Wills should contain your current choice for guardians for minor children, and your best options for executors. Finally, do not forget the usefulness of durable powers of attorney, which can be used by your family to conduct your financial affairs in the event that you become incapacitated for an extended period. If you own a small business, make sure that your business succession plan is up to date and reflects the wishes of all the owners. Speak to your estate planning attorney as soon as possible to address any of these concerns.

Keeping a balanced approach in your level of concern, your preparation, your investment choices, and your legal affairs will help minimize the impact of Coronavirus on your financial and estate planning.

Source: Forbes, February 27, 2020 Coronavirus Stock Crash Impact on Your Retirement and Financial Planning